Our ultimate beginners guide to investing – how to turn £100 into £19k and three must-follow tips

INVESTING isn’t just for the super rich, you can start with as little as £1 - and the earlier you get going, the more your money can grow.

Here Holly Mead, who has 14 years of experience writing about investing, helps you get started with her ultimate guide to getting started.

Firstly, do you have enough money to invest? Experts say you should have three to six months' worth of wages in a savings account you can access before you start.

And are you prepared to lose it all. Once you've had this frank chat with yourself you can get going.

You need to be willing to invest cash for at least five years to mitigate any dips and allow your money to recover.

You can start with as little as £1 - but the returns you make will depend on how much you invest and where.

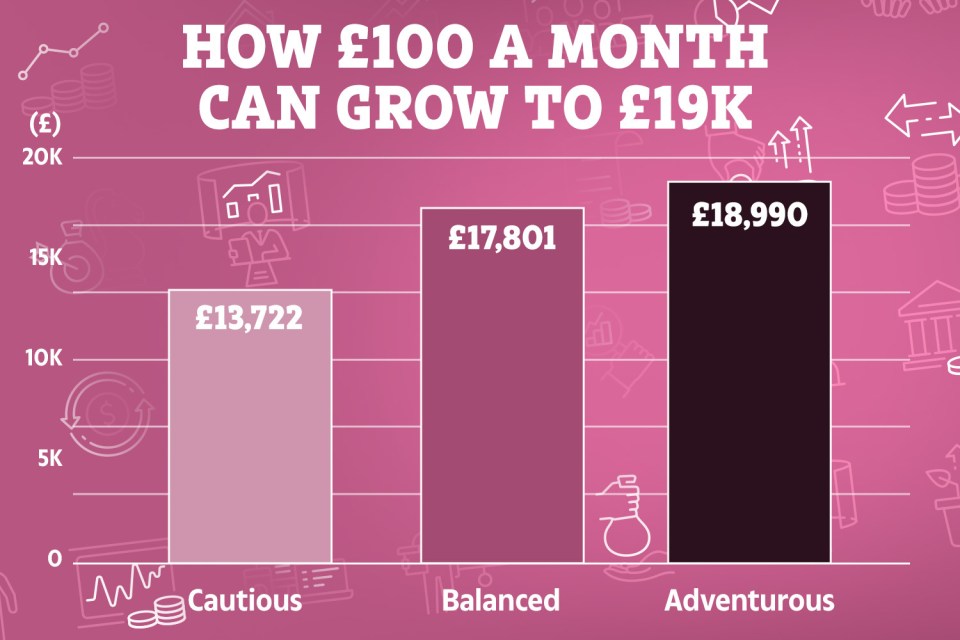

If you invested £25 a month in a cautious fund, after 10 years you could have £3,337 and if you chose an adventurous fund you could have £4,599, according to Moneybox.

If you invested £50 a month in a “balanced” fund, after 10 years you could have £8,802 and investing £100 a month in the same fund could grow to £17,801.

But put £100 a month into an “adventurous” fund and it could grow to a hefty £18,990 after 10 years.

Where to start

For a new investor, choosing a ready-made fund is often the simplest way to get started.

Others, like Hargreaves Lansdown and AJ Bell, have ready made “mult-asset” funds, which invest in a range of different things such as company shares, bonds issued by governments or companies, and gold.

Having a diverse spread of investments can help reduce the risk of ups and downs.

‘People think you’re rich if you invest, but that’s not true’

MARTHA Burns started investing in June 2023 after watching YouTube videos about how to get started.

“I have always saved and made sure I had enough for a rainy day, but I wanted my money to grow,” she said.

Martha, 39, who lives in Bermondsey, London, opened an account with investment firm Vanguard and set up a direct debit to invest £100 a month.

She chose the Vanguard US Equity Index fund, which tracks more than 3,500 American companies. It would have grown a £1,000 investment to £2,172 over five years.

“I wanted to invest in America because it is the most important economy in the world. I knew it had performed well and believe it will continue to do so,” said Martha, a comedian.

She selected Vanguard after reading positive reviews about the company and seeing it had low fees.

It charges £4 a month for a Stocks and Shares Isa plus her fund fee of 0.1 per cent. She plans to leave her money invested for at least 20 years and hopes she will be able to invest more in the future.

In less than two years, Martha’s pot has grown to more than £2,200. “The moment you mention that you invest, people assume you are secretly loaded, but that is not the case.

"You can start with a small amount and it is easier than you think,” said Martha.

But what type of investor do you want to be?

“Cautious” or lower-risk funds have a smaller proportion invested in the stock market and more in government bonds and gold.

“Adventurous” funds have more in the stock market, which can mean greater returns but also more risk.

“Balanced” funds are somewhere in the middle. It is important to check what your fund invests in before you commit any money to make sure you feel comfortable.

Most apps let you set up a direct debit to invest a set amount each month, so you don’t have to remember to do it.

This can help boost your returns over the long-term because it means you invest consistently, even when the stock market falls.

Sarah Coles from Hargreaves Lansdown said: “Don’t feel you have to be able to go on Mastermind with investing as your special subject to get started.

"If you set up a direct debit into a diverse fund, like a multi-asset fund, and pay into it gradually, you will be surprised how it can build over time.”

The best apps to use

Choosing the right app or website for you can be confusing as there are a lot out there.

When deciding, it is important to look at the fees and the minimum amount you need to invest.

Check that it offers the types of investment you want, see if you like the look and feel of the app, and read reviews from other users.

Wealthify is a good option for newbies as you can start investing with just £1.

You choose how much you want to invest, how confident you are and whether you want ethical investments, and it does the rest. It charges 0.6% a year plus the cost of your fund.

Nutmeg is a popular option but you will need £500 to get started. Its “fixed allocation” option invests your money based on the level of risk you want to take, with five options from low to high.

For a £500 investment it charges 0.65% a year, which is about £3.25.

Companies like Hargreaves Lansdown and AJ Bell are popular with people who want to be more hands-on in choosing the funds and shares they invest in, and offer a huge amount of choice as well as best buy lists to help you whittle down the option.

Be aware of risk

IF you have enough cash savings to invest - then the returns are impressive.

On average, since 1899 the stock market has delivered an average return of 4.8% a year, compared to an average of 0.5% if you kept your money in cash savings, according to Barclays.

That means if you had put £100 in the stock market in 1899 it would be worth £31,888 in real terms today, while the same amount put in cash would be worth just £190.

But as we have seen recently, the stock market can also fall.

The American stock market saw its biggest drop since the start of the Covid pandemic after US President Donald Trump announced plans to introduce punitive tariffs on goods imported to the US from other countries.

The UK’s own stock market, the FTSE 100, fell by more than 10 per cent after the news.

This is only actually a problem if you need to access your money but if you’ve got a long-term savings goal then the market will usually bounce back.

Ups and downs in the market are called “volatility”, but the idea is that over the long-term you can ride out these bumps and your money will grow, although it can feel uncomfortable at the time.

That means it is crucial that anyone considering investing is willing to tie their money up for a minimum of five years, as this gives your investments time to recover from any dips.

You do need to be prepared to lose it all.

How much does it cost?

There are two main costs to be aware of when investing.

Firstly, you will pay a fee for the app or website you use - this is either a flat rate per month or year, or a percentage of the amount you invest.

For example, if you invested £500 and the fee was 0.5%, this would be £2.50 a year - although be sure to check whether there is a minimum charge.

Then you will also pay for the actual investments you choose. This will either be a set charge each time you buy or sell an investment, or a percentage of the amount you invest.

My top three investing tips for beginners

BRIAN Byrnes, head of personal finance at Moneybox, shares his top tips...

- Set a goal: Whether it's buying a home, retiring early or simply building your wealth - set a target and a timeline for how long you expect to take to reach your goal. Try to dedicate 30 minutes a week to learning about investing topics like stock market trends and compound interest as this will help you feel more confident.

- Keep costs - and risks - low: Consider lower-risk options like index funds, which track a certain stock market like the FTSE 100 or S&P 500. These are often cheaper than other investments and are diversified because they invest in hundreds of companies, which helps to reduce your risk. Investing small amounts every month will help you to stay consistent.

- Use an ISA: Every adult can save £20,000 a year into an ISA and all the gains you make are completely tax-free. If you are saving for your first home, consider a Lifetime ISA - you can save up to £4,000 a year in these accounts and get a 25% bonus from the government. Not having to pay tax on your gains helps to accelerate your growth.