EMPLOYEES could work one day a week and earn up to 73% of their wages under changes to the Job Support Scheme made by Rishi Sunak today.

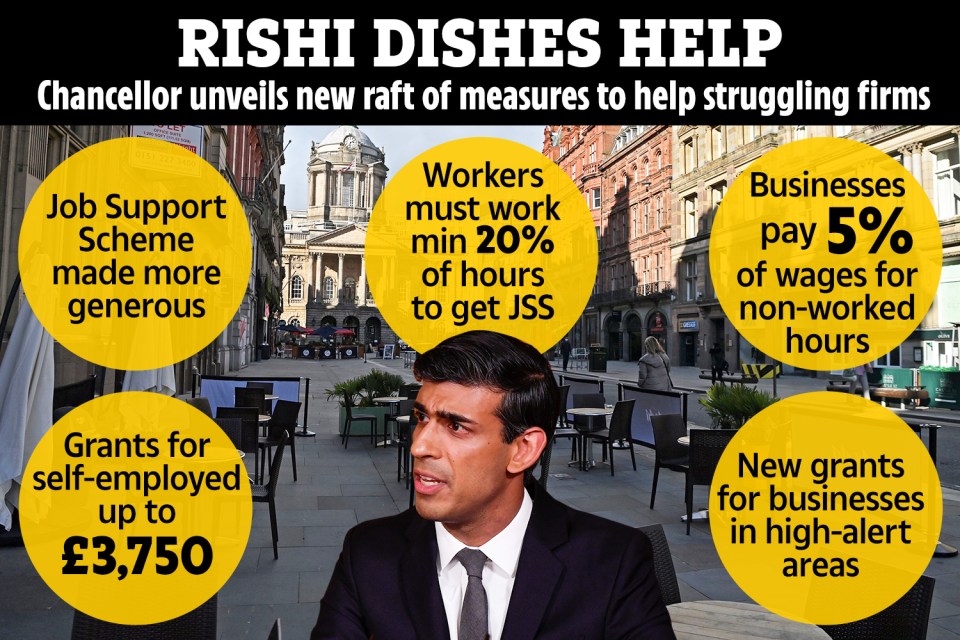

The Chancellor announced that employees can now work for a minimum of 20% of their contracted hours part-time and still qualify for help.

⚠️ Read our coronavirus live blog for the latest news & updates

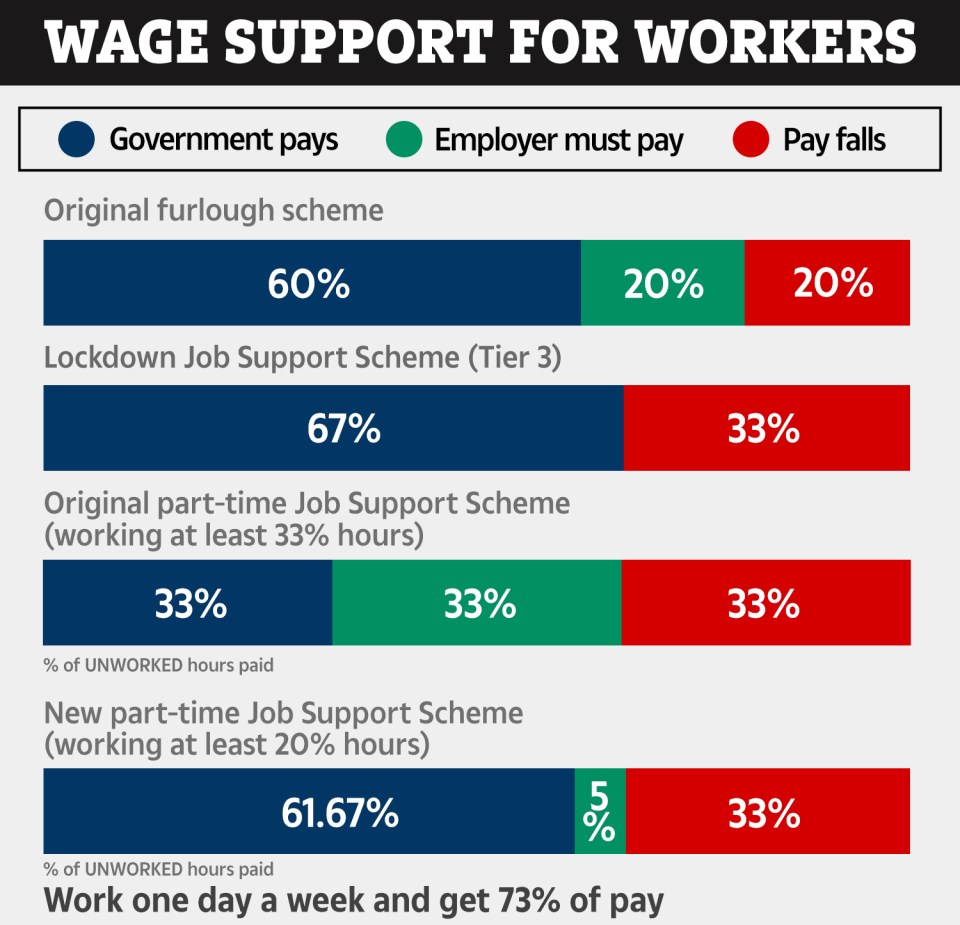

Previously, employees on the scheme would have needed to have worked a minimum of 33% of their hours to be eligible, and businesses must contribute a third of wages.

The government will pay 61.67% of employee wages while businesses will pay just 5% for hours they don't work.

Employees will still be able to get full pay for hours they do work.

Previously, for hours not worked employers were required to pay 33%, the government would cover 33%, with workers losing out on 33% of pay.

Today the Chancellor announced:

- The Job Support Scheme which replaces the furlough scheme at the end of the month is made more generous for businesses

- Employees must work a minimum of 20% of hours to get help

- Businesses will pay just 5% of wages for hours not worked - down from around 33%

- Grants for self-employed people raised up to £3,750

- New grants for businesses in high-alert areas in Tier 2 and 3

Grants for self-employed workers will also double to cover 40% of previous earnings, up to £3,750, and new grants for businesses in high alert areas.

Mr Sunak said: "I’ve always said that we must be ready to adapt our financial support as the situation evolves, and that is what we are doing today.

"These changes mean that our support will reach many more people and protect many more jobs.

"I know that the introduction of further restrictions has left many people worried for themselves, their families and communities.

"I hope the government’s stepped-up support can be part of the country pulling together in the coming months."

It will be the second major amendment the Chancellor has made to the JSS since is was announced last month.

The JSS will replace furlough from November 1. Here's everything we know about it so far:

What is the Job Support Scheme?

The Chancellor announced that the furlough scheme will be replaced by the JSS from November 1 for six months.

It's more complicated than the furlough scheme, with different levels of support depending on the businesses' needs.

But overall, the idea is that it keeps workers in "viable" jobs even if their hours are reduced due to a drop in demand throughout colder months.

Anyone who is in employment as of September 23 can be put on the scheme - and it's open to all small and medium-sized businesses who didn't apply to furlough before.

How will the changes to the Job Support Scheme work?

Employees must work a minimum of 20% of their contracted hours in order to qualify for the JSS. Previously this was 33%.

For hours they don't work, they will get 67% of wages paid and they will lose 33% of pay.

This is made up of the government paying 61.7% of non-worked hours while employers will pay 5% of non-worked hours.

The government will pay up to a maximum of £1,541.75 per month for non-worked hours.

While employers will pay up to a maximum of £125 a month for non-worked hours.

The caps are based on a monthly salary of £3,125 a month.

It means that a full-time employee paid £1,100 per month would get £807 a month.

Employers will pay £283 while the government will pay the rest.

Who is eligible?

All employers with UK bank accounts and UK PAYE schemes can claim the grant. They don't need to have use the furlough scheme to apply.

Large companies (with more than 250 employees) have to meet a financial impact test. It means the scheme is only available to those whose turnover has stayed the same or is lower than before Covid.

There is no financial impact test for SMEs or charities.

Staff on any contract are eligible, even those on zero hours or agency workers.

What about self-employed workers?

Self-employed workers will able be able to benefit from a government grant of up to £3,750 - double the support of what was on offer before.

The Treasury previously said it would cover 20% of average monthly profits, up to a total of £1,875, covering November to January next year.

But it will now increase this amount to 40%.

An additional second grant will also be available for self-employed workers to cover February 2021 to the end of April.

The government hasn't said how much this second grant will cover.

Most read in Money

What about pension and national insurance contributions?

Under the scheme, employers are expected to cover the cost of workers' pension and national insurance contributions.

This is not changed following today's announcement.

Here we explain what financial support available to you if you have to self-isolate due to coronavirus or there's a local lockdown.

Read More on The Sun