MARTIN Lewis has given his verdict on the Spring Budget 2024.

Jeremy Hunt today offered more help with child benefits to parents earning more than £50,000.

And the Money Saving Expert hailed the Chancellor's decision saying "WE GOT THE WIN ON CHILD BENEFIT!"

The 51-year-old tweeted: "Chancellor tipped me off before budget, said this was due in large to MSE/my shows campaigning all based on all those of your who messaged me to say it was the key thing to put to him."

In his Spring Budget, Mr Hunt explained how child benefit is withdrawn when one parent earns more than £50,000 a year.

He said: "That means two parents earning £49,000 a year receive the benefit in full but a household earning a lot less than that does not if just one parent earns over £50,000.

Spring Budget at a glance

- Fuel duty will be frozen and the 5p cut extended for a year

- Alcohol duty will be frozen until February next year

- National insurance was cut by an additional 2p

- An extension of the Household Support Fund for the fifth time

- Households on Universal Credit will get an extra year to repay emergency loans from the Government

- A new tax on vapes, which will cause prices to rise

- A one-off new tax on fags to ensure they are more expensive than the electronic alternative

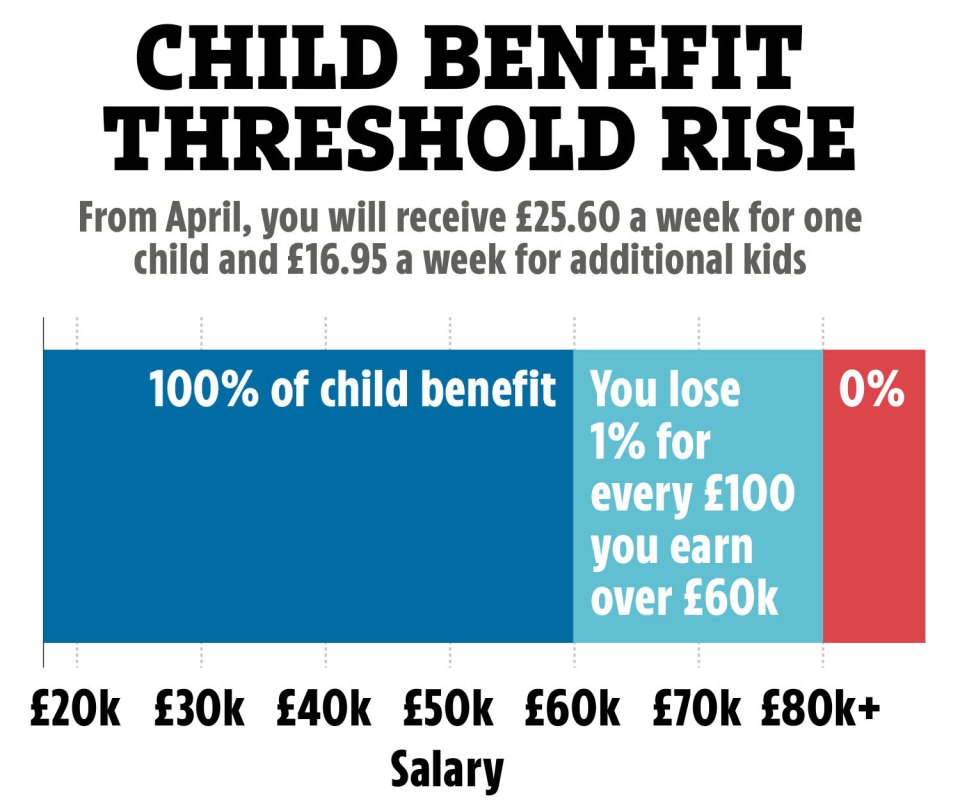

- The high income child benefit charge was raised from £50,000 to £60,000

"Today I set out plans to end that unfairness. Doing so requires significant reform to the tax system including allowing HMRC to collect household level information.

"We will therefore consult on moving the high-income child benefit charge to a household-based system to be introduced by April 2026.

"But because that is not a quick fix, I make two changes today to make the current system fairer."

He continued: "I confirm that from this April the high-income child benefit charge threshold will be raised from £50,000 to £60,000.

Most read in Money

"We will raise the top of the taper at which it is withdrawn to £80,000.

"That means no one earning under £60,000 will pay the charge, taking 170,000 families out of paying it altogether.

"And because of the higher taper and threshold, nearly half a million families with children will save an average of around £1,300 next year."

Martin explained: "So 1) From this April threshold which hasn't moved since 2013 rises from a single parent earning £50,000 to £60,000 and you lose child benefit totally at £80,000 (not £60,000).

"2) Consultation on moving it to family income not individual income and hopefully that'll be in place from April 2026 (this is to stop unfairness for single income/single parent) families."

Before the Budget was announced, Martin tweeted that he was watching out for two specifics.

He wrote: "Will he change Child Benefit Higher Income charge (ie stop penalising single parent, single income & dominant income families).

"Will he ditch penalty for Lifetime ISA withdrawals if buying house over £450,000."

Child benefit

Everything to know about child benefit:

How much is child benefit and when does it stop?

How long does child benefit take to claim and is it means-tested?

What age do child benefits stop and can I claim for a third child?

Are child benefit payments going up and how much more will I get?

What is the high-income child benefit charge?

If either parent or carer starts earning over £50,000, they have to start paying the high-income child benefit charge.

This means you have to pay back 1 per cent of your child benefit for every £100 of income earned over the £50,000 threshold.

Once you reach £60,000 of yearly income you have to repay the full amount of child benefit received.

Parents have been caught out by the complicated rules and extra charges and landed with bills for thousands of pounds.

It's up to parents to notify HMRC if they are liable for the charge and they must file a self-assessment tax return to pay it.

Are you missing out on benefits?

YOU can use a benefits calculator to help check that you are not missing out on money you are entitled to.

Charity works out what you could get.

Entitledto's determines whether you qualify for various benefits, tax credit and Universal Credit.

MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto's data.

You can use to determine which benefits you could receive and how much cash you'll have left over each month after paying for housing costs.

Your exact entitlement will only be clear when you make a claim, but calculators can indicate what you might be eligible for.

What is child benefit and who is eligible?

Child benefit is paid to parents to help with the costs of childcare.

Payments are usually made every four weeks, plus by claiming child benefit you also get National Insurance credits that count towards your State Pension.

Currently, parents can claim £24 per week for their first or only child - £96 a month and £1,248 a year.

But, from April the rate for your eldest or only child will go up to £25.60 a week - equating to around £102.40 a month or £1,334.86 a year.

For any additional children, they can claim an extra £15.90 a week per child - £63.60 a month and £826.80 a year.

And, from April for every other child, you'll get £16.95 a week, which is £67.80 a month and £883.82 per year.

You normally qualify for child benefit if you live in the UK and are responsible for a child under 16.

Parents can also claim the support for a child under 20 if they are in approved education or training.

When two or more people share the responsibility of caring for a child, it can only be claimed by one person.

You'll be responsible for a child if you live with them or you are paying at least the same amount as child benefit towards looking after them.

This might mean you are paying the equivalent amount of child benefit on food, clothes or pocket money.

You should bear in mind, eligibility changes if a child goes into hospital or care and if your child starts to live with someone else.

Usually, you get child benefit for eight weeks after your child goes to live with a friend or relative - as long as they don't make a claim.

But it can continue for longer if you make contributions to your child's upkeep.

Foster parents can also claim child benefit, as long as the council is not paying anything towards their accommodation or maintenance.

Legal guardians or parents adopting a child can also apply for the benefit, but the child has to be living with them.

You will only be able to claim for a short period if you leave the UK, for example, if you go on holiday or for medical treatment.

For anyone not sure about eligibility, you can contact the Child Benefit Office.

Meanwhile, here are four ways to avoid the child benefit tax trap – but still gain £1,248 a year in free cash.

Plus, here are 17 big money changes in 2024 and what they mean for you – including a £1,800 pay rise for millions and free childcare.

Read More on The Sun

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Facebook group to share your tips and stories.