The worst banks for refusing to refund victims of card fraud revealed – and how to get your cash back

Banks are supposed to refund customers immediately but they don’t always get it right

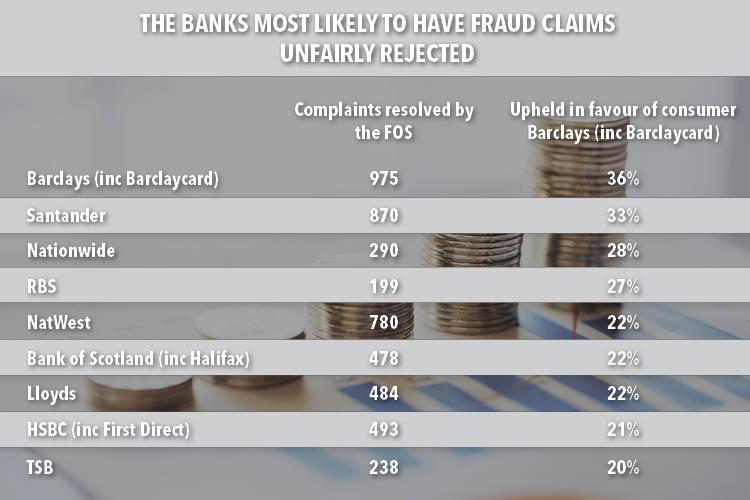

BARCLAYS is unfairly rejecting card fraud claims in more than a third of cases, an investigation has revealed.

Banks are supposed to refund customers immediately - unless they suspect wrongdoing - but they don’t always get it right.

Between April 2015 and February 2017, the Financial Ombudsman Service resolved 5,800 complaints relating to fraud and disputed transactions, and upheld 28 per cent of them in favour of customers.

An investigation by has today revealed that Barclays has the worst record for handling fraud-related complaints.

Even the best of banks that the consumer group looked at, TSB, had unfairly rejected one in five claims.

The research only looked at banks with more than 100 resolves cases.

The cases relate to credit and debit card fraud, including misplaced transactions, missing payments, ATM disputes and incorrect debits taken by shops.

Harry Rose, money expert at Which? Said: “Fraudsters are becoming more sophisticated and only need a few hours to potentially empty someone’s bank account.

MOST READ IN MONEY

“Banks will always be a target for criminals and they have a duty to spot and respond to new threats.

“Most are working hard to combat card fraud, but we still hear from those who say their bank made them feel like a criminal, not a victim.”

A Barclays spokesperson said: “We’re working hard to tackle the root causes of complaints and get it right for our customers first time.

FIVE CARD FRAUDS TO BE WARY OF

THESE are the main way the scammers get hands on your money:

- Remote purchase fraud or card-not-present fraud - when your card details are stolen and used to buy goods online, by phone or by mail order

- Lost or stolen cards - when a criminal uses your card to purchase (in a shop or online) or take money out from an ATM

- Card not received fraud - When a new or replacement card is stolen before you get it in the post

- Counterfeit card fraud - When a fake card is created using details from the magnetic strip or a genuine card. They may use the details to clone your card and use it in a place where chip and pin isn’t available, such as the US

- Card ID theft - When a fraudster uses fake or stolen documents to open up an account in your name or take over an existing account

“We know from this survey as well as wider independent data that we’re making progress, but there is still more to do as these figures show.

“We will continue to take the action required to deliver the best experience possible for our customers.”

If you’ve been the victim of credit or debit card fraud, acting quickly is essential.

The that explain what you should do and how to get help.

If your card provider won’t refund your money then you can complain to the Financial Ombudsman Service.

GETTING A FRAUD REFUND: YOUR RIGHTS

A bank can only refuse to refund you for an unauthorised payment if:

- It can prove you authorised the transaction

- It can prove you are at fault because you acted fraudulently or failed to protect your pin.

- You left it more than 13 months after the date of the unauthorised transaction

You may have to pay up to £50 of an an unauthorised transaction if your card has been lost or stolen or your bank can show you failed to keep your password or pin safe.

But you’re not liable for any unauthorised payments made after you notified the bank or card issuer.

You can fill in a form online and submit your claim. It will consider your circumstances and make a decision.

A spokesman from the Financial Ombudsman Services said: “Regardless of the type of scam – or the amount of money that’s been lost – the ordeal of being scammed may be distressing, and even life-changing.

“From our conversations with financial businesses, we know that protecting customers is high on their agenda. And it makes sense that part of the solution will be ensuring that technology and other safeguards keep one step ahead of the scammers.”

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at [email protected] or call 0207 78 24516