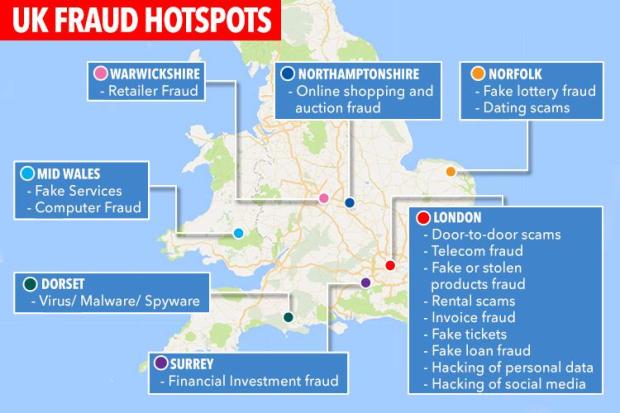

Do you live in a fraud hotspot? Which? reveals top places where scammers hit – and how they steal your cash

Norfolk is revealed as the hotspot for reported dating fraud, with 8,311 victims reported nationally being scammed into sending money to a prospective 'lover'

BRITS have already been told to update their passwords and to never share their banking details with their Tinder dates, but now it seems where we live could be a factor when it comes online fraud.

Consumer group Which? has obtained thousands of fraud reports made by victims across the UK from 2014 to 2016 under the Freedom of Information Act.

Which? used these to map areas where certain types of fraud appeared to be more common.

It found that online dating scammers are mainly targeting residents of Norfolk with more than 8,000 victims reporting being scammed into sending money to a prospective “lover”.

This means 1.6 people per 10,000 were affected in the county, compared with the general national average of 1.1.

Norfolk was also a hotspot for reported lottery scams - where victims are duped into paying to enter a non-existent prize draw - with 2.2 reports per 10,000 people compared with 1.0 across the UK.

Residents in Northamptonshire are most likely to report being hit by online shopping and auction scams, reporting that a product sold online didn’t exist, arrive or match its description.

This affected 21.6 victims per 10,000, compared with 16.9 nationally.

Brits living in Dyfed-Powys, in mid-Wales, were most likely to report losing money to computer repair fraud - where cold callers offering to fix a non-existent computer glitch - with residents reporting almost a thousand cases.

Areas with an older popular were more likely to be report this type of fraud, according to Which?.

Due to its large concentration of people and money, Which? said London is a hotspot for various reported scams.

These include include being charged fees for fake loans, social media or email hacking, scam door-to-door sales, fraud involving false or stolen goods and ticket fraud.

Gareth Shaw, money expert at Which said fraudsters are finding it easier to know who to target and how as we share more information than ever online.

How to protect yourself from a scam?

WHAT to look out for to make sure you don't fall for a scam:

- A retailer will never ask for personal information to be supplied via a website in return for vouchers - requests for you security details such as your PIN or full password should be ignored.

- Keep an eye out for phony emails - An official email from a major organisation will not contain typos. Delete it. American spellings in emails purporting to be from UK firms can also be a giveaway. Do not assume an email request is genuine.

- Choose strong passwords and don't write them down - Strong passwords have eight characters or more and use a combination of letters, numbers and symbols

- Beware of attachments - Don’t click on attachments or prompts to install software on your computer.

“These criminals are constantly finding new ways to rip us off and those tackling fraud should be upping their game," he said.

"The Government needs to set out an ambitious agenda to tackle fraud, while law enforcement agencies need to be working harder to identify and protect the people most at risk from fraud,” he added.

THE INTERACTIVE MAP OF THE KEY FRAUD HOTSPOTS IN THE UK

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at [email protected] or call 0207 78 24516