How big a deposit do you think you need to buy a house? It could be £75k MORE than you’ve saved

The average deposit needed to buy a home now stands at a whopping £49,639

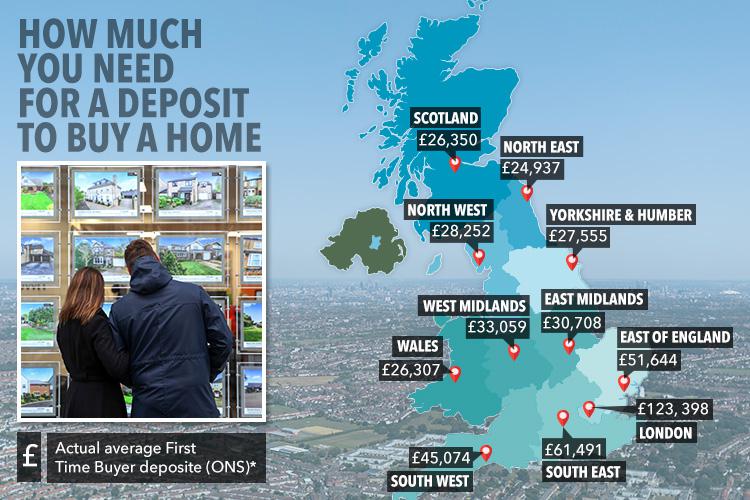

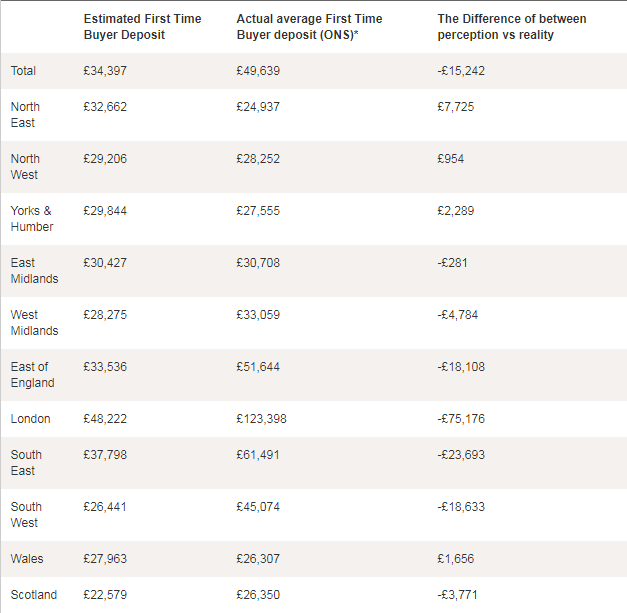

FIRST-TIME buyers underestimate how much they need for a deposit by an average of £15,000 - but for Londoners it can be as much as £75,000 more.

Brits looking to take their first step in the property ladder think they need just over £34,000 for a deposit, Aldermore Bank has found.

But according to figures from the Office of National Statistics (ONS),the average deposit to get a first home is £49,639 - leaving a shortfall of £15,388.

It's even worse for buyers in London.

Those in the capital are aiming to save an average deposit of £49,000 when in fact the average deposit needed is £123,000 - more than double what is required.

Buyers in the south east also face similar problems, with those expecting to get a home on a deposit of £37,798 likely to be severely disappointed.

They'll have to scrape together more than £61,000 - a shortfall of over £23,000.

At the other end of the scale, those in Wales are looking to save nearly £28,000 for a house when an average deposit is just over £26,000.

Buyers in the north east think they need £34,397 to get a house, when really the average deposit is just £24,937- a difference of more than £7,000.

As well as deposits, Aldermore found widespread confusion about a host of house-buying issues.

Some 32 per cent simply have no idea how much they can expect to pay for the associated costs of buying a home like stamp duty and solicitor fees.

And of those who have bought, 40 per cent spent more than they expected to by an average of £2,334.

More than half (58 per cent) think they can reach their deposit goal within five years but in reality only 51 per cent do - and 16 per cent take more than eight years to save enough.

STAMP IT OUT Is stamp duty stopping you from buying a home? These property developers will pay it for first-time buyers

The bank also warned that first-time buyers need to be wary of the costs of sale falling through.

It found 47 per cent of first-time buyers had experienced a deal collapsing, at a cost to themselves of £1,305.

Mortgage expert at Aldermore, Charles McDowell, said: “It is clear there is a divergence between perception and reality when it comes to the house buying process.

"This often means those looking to buy are underestimating the associated costs as well as the time it could take to complete, especially with first time buyers expecting it to take four years on average to save for a deposit."

Potential buyers are finding it increasingly difficult to get on the property ladder, with many relying on help from their parents to scrape together a big enough deposit.

At this month's Tory party conference, the Government announced £2billion in funding to build new council houses.

But it quickly emerged the money would only allow 25,000 new homes to be built over the next five years.

How to get help buying a house

THERE are several government schemes available to help you get on the housing ladder.

- Help to Buy loan: This scheme is for those who have a 5 per cent deposit, and is only available on new-build properties that are worth less than £600,000. The government lends you up to 20 per cent of the property value (interest-free for the first five years) which gives you access to cheaper mortgages. You will need to pay this back at the end of the mortgage or when you sell.

- Starter Homes: First-time buyers under the age of 40 can access this new scheme. You’ll get a 20 per cent discount on the market value of the property (new-build only) but you cannot sell or let the property for five years after you buy it.

- Shared ownership: This scheme is available to non-homeowners who earn £80,000 a year or less (£90,000 in London). People can buy a share of a home from a housing association and continue to rent the remainder. Buyers will need a ten per cent deposit as well as money to cover stamp duty and other fees. You’ll also need to find a mortgage lender that is willing to lend on shared ownership properties

More on money

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at money@the-sun.co.uk or call 0207 78 24516