Budget 2017 First-time buyer Anna could save £5,000 thanks to today’s Stamp duty cut

Anna Walker, 33, has been saving to buy a house with her husband Joe. The new measures announced by the Chancellor today mean that she could save £5,000.

FIRST-TIME buyer Anna Walker could save £5,000 thanks to the new Stamp duty cut announced in today's Budget.

The 33-year-old is planning to buy a three-bedroom semi-detached house in Staines-upon-Thames, Surrey with her husband Joe, later this year.

Mrs Walker said that the couple had been saving for a deposit for years, but struggled due to the high cost of rent and starting a family.

She said: "That is brilliant news. Before, we didn't have any money left over to make improvements on the property, every penny was put into our deposit.

"Now we can afford to do some much-needed work on the place. I am over the moon."

The secondary school teacher, said that stamp duty has “massively” affected their budget.

“With every house we've looked at, we've considered the stamp duty – it’s easily another ten thousand pounds on top of our deposit. We have always had to keep it in mind when budgeting.”

Currently, the rate of stamp duty you'll pay depends on where in the UK you're buying a property. England, Wales and Northern Ireland have the same rates, Scotland uses different rate bandings.

MORE BUDGET NEWS

Before today’s announcement, someone buying a home would have had to pay tax that was calculated on the part of the property purchase price that fell within specific bands.

For example, on their £380,000 house, the amount originally owed was calculated as follows: 0 per cent on the first £125,000 = £0, 2 per cent on the next £125,000 = £2,500, 5 per cent on the final £130,000 = £6,500. For a total of £9,000.

Now, the couple will pay nothing on the first £300,000 and then 5 per cent on the remaining £80,000, adding up to a total of £4,000.

How to calculate stamp duty

HOW we calculate stamp duty under the current system in England depends on whether the property is your first or second home.

The current system in England for residential properties means:

- You pay nothing if the property costs below £125,000

- You pay 2 per cent if it is worth between £125,001 and £250,000.

- You pay 5 per cent if between £250,001 and up to £925,000

- You pay 10 per cent if it is between £925,001 and £1.5 million

- And finally 12 per cent on anything over £1.5 million

- However, in Wales people buying houses worth more than £400,000 and £750,000 will have to pay 7.5% tax from April 1 2018.

For second homes or buy to let properties:

- Zero rate band on purchases up to £150,000

- 2 per cent on purchases between £150,001 and £250,000

- 5 per cent on purchases above £250,001

The government provides a to let you know how much you would pay on a property.

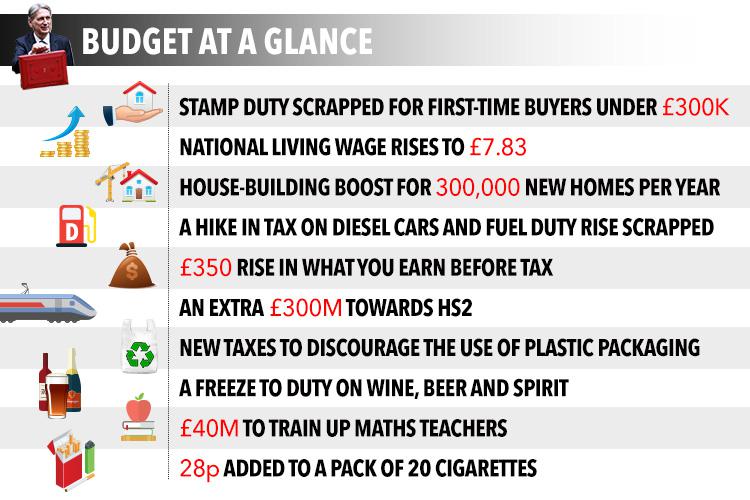

The Chancellor today announced an immediate cut for first-time buyers on purchases worth up to £300,000.

First-time buyers in London will be able to get the tax relief on the first £300,000 on properties worth up to £500,000.

It is unclear whether people looking to buy a property outside of London will also benefit from the scheme on the first £300,000 with a limit of £500,000.

Nail in the coffin for some diesel drivers

FOR mother of three, Lynn James, the increase in car tax, which could add up to £500 on to the first-year rate for diesel drivers, is “the final nail in the coffin” for buying this type of vehicle.

Mrs James, pictured here at her home in Knebworth, Hertfordshire, with her husband Vincent and son Josh, 8, said: “Right now we have a 2012 Ford S-max and drive around 400-500 miles per week for our children’s football, two of which play for Cambridge United.”

Mrs James, who runs the moneysaving blog, MrsMummypenny.com, calculates that the family spends £200 per month – or £2400 a year - on diesel.

The couple have been long considered opting for an electric car and the Chancellor’s announcement is a big motivation to make a change.

“We would never buy another diesel car and this increase in car tax will push us into this decision sooner rather than later,” she said.

Fuel duty had been frozen at 57.95p since January 2011 when it increased from 57.19p.

Oil prices have soared by £13 a barrel since the middle of the year, which is turn could see pump fees jump by 12p a litre before Christmas.

Figures from Confused.com's fuel price index show that diesel drivers already pay 122.4p per litre, a year-on-year rise of 3.65p.

“This scrapped increase in fuel duty is great news,” said Mrs James.

“An increase at the pump would have been a huge issue for us and that we thought could cost us an extra £15 to £20 per month, so freezing it will tide us over until we buy an electric car.”

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at [email protected] or call 0207 78 24516