Could the new digital mortgage lenders you’ve never heard make it easier and cheaper to get on the property ladder?

Challenger banks like Atom Bank are becoming increasingly popular as they move towards lending mortgages. But are they any better than ones on the high street?

IT'S easy for house hunters to get overwhelmed when it comes to getting a mortgage.

But with the rise of digital only banks, like Atom Bank, Revolut and Starling you no longer have to solely rely on ones on the high street to get you the best rates.

We've already reported that putting your savings in a bank that you've never heard of could actually earn you money.

Now digital banks are moving into the world of lending money, specifically mortgages. But are they any good?

What is a digital bank?

A digital bank delivers its services online, either through a website or often through an app.

They're different to online banking which is a service offered by high street banks where customers can access some of the services at home or on the go.

Unlike a high street bank, they don't have any branches and they communicate with customers through the app.

Revolut, Starling, Atom Bank and Monzo are some of the better known digital banks and are protected by the Financial Services Compensation Scheme (FSCS).

Can I get a mortgage from a digital lender and what are the benefits?

At the moment, it's only start-up Atom bank who's able to lend mortgages, through their Digital Mortgages scheme.

Starling told us it's something they're hoping to offer in the "immediate" future, while Revolut is looking to move that way too.

They offer residential and business mortgages, up to £300,000 for first time buyers and they'll remortgage your home too, subject to meeting the criteria.

Last year, Atom was able to offer Britain's lowest ever mortgage deal but were forced to withdraw it after just nine days.

The five year deal was available to people who had a 40 per cent deposit. The interest rate was 1.29 per cent.

At the time, mortgage expert said that it was as good as rates offered by high street banks that were locked in for only two years.

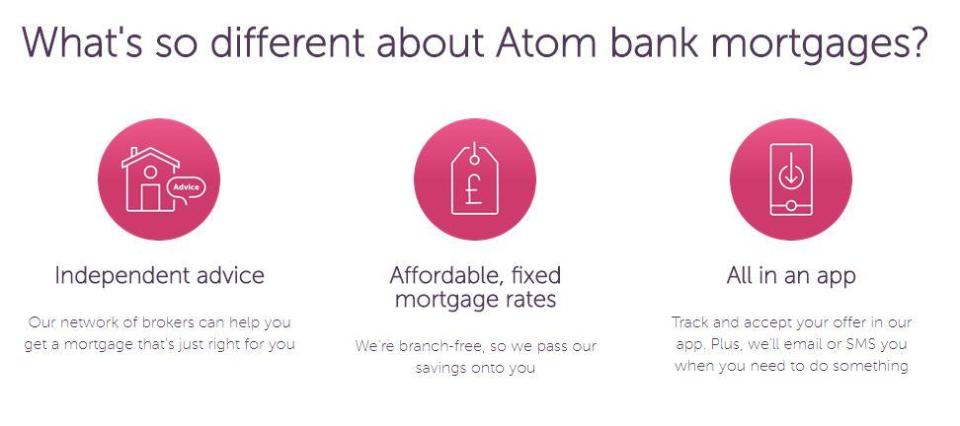

"Digital mortgage lenders are not constrained by the same legacy architecture that hampers the more established, high-street banks because they’ve only been around for a few years rather than hundreds," explains Ishaan Malhi, the brains behind digital mortgage broker Trussle.

What help is out there for first-time buyers?

GETTING on the property ladder can feel like a grim task but there are schemes out there to help first-time buyers own their own home.

Help to Buy ISA - It's a tax-free savings account where for every £200 you save, the government will add an extra £50. But there's a maximum limit of £3,000 which is paid to your solicitor when you move.

Help to Buy equity loan - The government will lend you up to 20 per cent of the home's value - or 40 per cent in London - after you've put down a five per cent deposit. The loan is on top of a normal mortgage but it can only be used to buy a new build property.

Lifetime ISA - Another government scheme that gives anyone aged 18 and 39 the chance to save tax-free and get a bonus of up to £32,000 towards your first home. You can save up to £4,000 a year and the government will add 25 per cent on top.

Shared ownership - Co-owning with a housing association means you can buy a part of the property and pay rent on the remaining amount. You can buy anything from 25 to 75 per cent of the property but you're restricted to specific ones.

"First dibs" in London - London Mayor Sadiq Khan is working on a scheme that will restrict sales of all new-build homes in the capital up to £350,000 to UK buyers for three months before any overseas marketing can take place.

Starter Home Initiative - A government scheme that will see 200,000 new-build homes in England to be sold to first-time buyers with a 20 per cent discount by 2020. To receive updates on the progress of these homes you can register your interest .

"As a result, they are able to build more efficient systems and operate at a lower cost, passing these efficiencies on to consumers in the form of cheaper rates."

What are the downsides of getting a mortgage from a digital lender?

Unfortunately, Atom had to pulled that particular mortgage after only nine days.

Whilst this isn't unusual for banks to do this - limited low rates are often offered to tie you in - it is something that's is more likely to happen at a smaller one.

Ishaan explains: "The caveat is that challenger banks like Atom are just starting out and can’t fund the volume of mortgages that much larger banks and building societies can, especially when offering such competitive rates."

Is it easier to get a mortgage?

When it comes to getting on the property ladder, you can either pay for a mortgage broker to help you find the best deals or you can go it alone.

Whilst there are digital mortgage brokers like Trussle and Habito offering you free and tailored advice, you can also talk to your bank's mortgage adviser for free too.

Of course, you're still subject to background and credit checks by the banks before they commit to lending you any money.

With Atom bank, you're subjected to the same checks, so even if you find a great rate you might not be able to get it.

Finance expert Andrew Hagger reckons there's no problems borrowing from the digital bank.

He says: "Atom Bank is fully regulated so there are no issues with borrowing from them.

How to get a mortgage

LOOKING to get on the property ladder? Here's some advice from the MoneyAdviceService to help you get a mortgage:

Talk to your bank - A mortgage advisor at your bank is usually free but they'll only tell you about their own offers.

Choose the right broker for you - Some brokers are tied to specific lenders, some look at deals from a specific list of lenders and some look at the whole market. The expertise come at a price, as some brokers can charge up to £500 for the service, which will eat into the cost of moving.

Check comparison sites - They're a good starting point but bear in mind they may have deals with specific lenders and they may be more likly to push those deals that might not necessarily be the right one for you.

You can go it alone - But if you do choose to go with a broker then you're protected by the Financial Ombudsman if things go wrong later down the line.

"As I understand it at present they only offer their mortgages via a broker - so first step is to find a broker."

Atom has a long list of brokers on it's website but unlike a high street bank, you can track you application progress via the Atom app, meaning you'll know exactly when it's approved - or rejected.

Andrew also recommends using a digital mortgage broker to help you along the digital process.

He says: "There will be a lot of the process carried out online or via an app, but you'll always have the opportunity of speaking to a human being.

"This is essential for most people when undertaking the largest financial transaction of their lives - they need that personal voice of reassurance."

Most read in money

House hunters can now find out what the best mortgage deals are on offer to them by chatting to a Facebook bot.

Digital mortgage brokers Nuvo has launched an automated chatbot on Facebook Messenger aimed at giving advice to people looking for a mortgage.

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at [email protected] or call 0207 78 24516. Don't forget to join the for the latest bargains and money-saving advice.