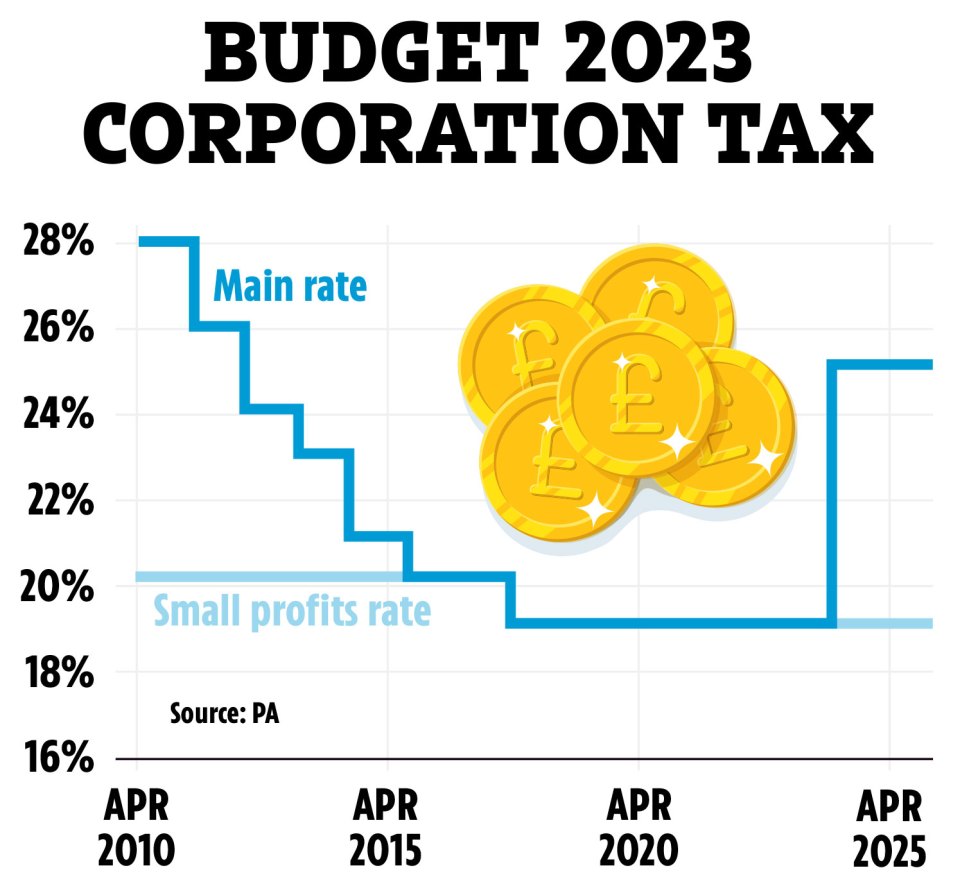

CORPORATION tax WILL be hiked from 19 to 25 per cent from April, in gloomy news for firms.

Chancellor Jeremy Hunt confirmed the controversial move at today's Spring Budget unveiling - but he tried to sweeten the deal by extending their tax breaks.

The move risks sparking a major backlash from backbench Tory MPs, who think taxes are high enough as things stand.

And it could make the price of everyday products more expensive, as companies pass on the tax to consumers.

The hike is only set to affect around 10 per cent of businesses.

Firms with profits of less than £50,000 will continue to be taxed at 19 per cent, while companies with profits between £50,000 and £250,000 will be subjected to a tapered rate.

Mr Hunt revealed that the super-deduction tax relief will end, which allowed firms to get 25p back for every £1 they invest.

However, it will be replaced with a system where they will be able to invest in IT, plant or machinery and have the amount taken off their taxable profits in full - essentially a full refund of 100 per cent.

What new measures were announced in today's Budget? Everything you need to know:

- Britain is set to avoid recession this year AND inflation will tumble to just 2.9 per cent

- Local councils will receive £200m to fix potholes in a major win for motorists;

- Massive £5bn boost to defence spending confirmed;

- Fuel duty frozen for the13th year in a row AND the 5p cut has been kept in huge win for the Sun's Sun's Keep it Down campaign;

- Alcohol duty rates is set to rise in line with inflation, hitting punters in the pocket;

- But the Chancellor will cut the duty charged on draught pints in pubs across the UK by 11p in August;

- Energy companies will not be allowed to charge people with prepayment meters extra fees from July 1, bringing them in line with Direct Debit users;

- Households on benefits and receiving state pension will get a payment boost next month with the uprating of benefits set to go ahead in April;

- Millions of households will save £160 on energy bills after the Energy Price Guarantee that freezes the average bill at £2,500 will be extended to July;

- Parents of kids from nine months old will be given 30 hours of free support each week;

- The childcare allowance for parents on Universal Credit will be raised from £646 a month for a single child to £950 - and from £1,108 for two children to £1,630;

- New apprenticeships for over-50s - called "returnerships" - will be created, which will train older workers more quickly to lure them back to jobs;

- The lifetime pensions allowance will be ABOLISHED allowing wealthier Brits like doctors to save tens of thousands more into their retirement pot tax-free to encourage them not to quit work early;

- The minimum amount claimants must work before having to engage with government jobs coaches is set to rise from 15 to 18 hours per week.

And there will be a new "enhanced credit" for small and medium-sized businesses to spend more on science, research and development.

Film, telly and video game firms will also get extra help.

Theatres, museums and orchestras will have their tax reliefs extended.

And businesses will get tax relief on energy efficiency measures too to make their buildings warmer.

Find out more by reading our Spring Budget live blog here.

Rishi Sunak has insisted Britain will still have the lowest level of corporation tax in the G7.

Vacuum tycoon Sir James Dyson previously blasted ministers over the tax grab.

Before the Budget inventor Mr Dyson wrote to the Treasury citing Mr Hunt’s own words of high-tax economies damaging enterprise and affecting decision-making of bosses.

In a letter seen by The Sun, he said: “The Government has done nothing but pile tax upon tax on to British companies.”

Alongside hiking corporation tax, Mr Hunt launched his major drive to get millions of economically inactive Brits back to the office.

A series of “skills bootcamps” will be formed to tempt retirees back into work.

There will also be an expansion to the “mid-life MOT” scheme where people are offered financial advice to see whether they can actually afford to retire early.

Disability benefits claimants will soon be free to continue receiving payments after they return to employment.

The hated Work Capability Assessment used to judge eligibility for the sickness benefits will be scrapped.

Read More on The Sun

Under the current system, disabled people need to have the assessment and be found unable to work to receive additional support.

Meanwhile, about two million middle-class Brits will benefit from an increase in the lifetime pension allowance.