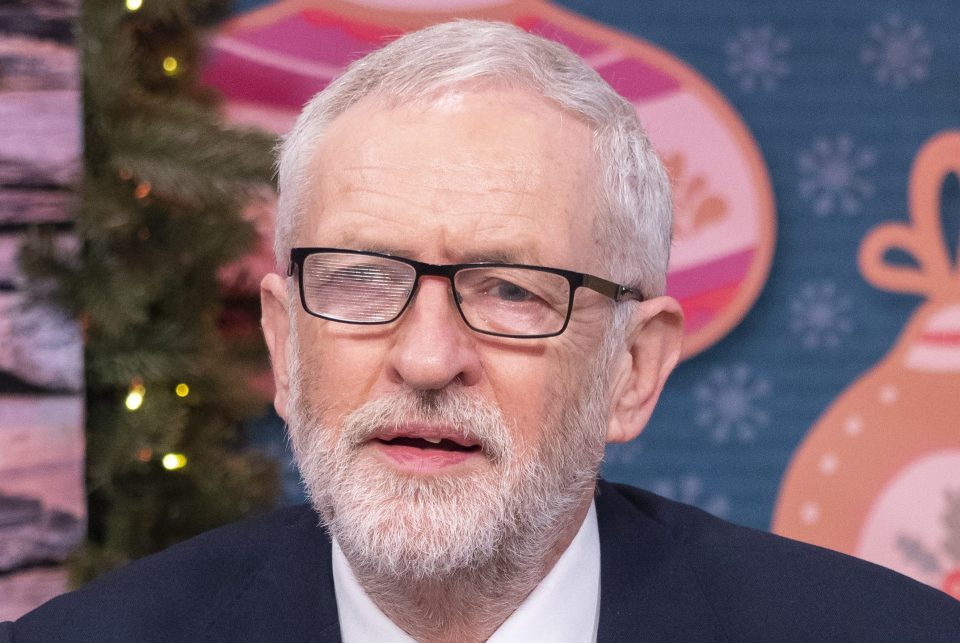

Jeremy Corbyn’s plans for massive renationalisation risk ‘years of disruption’

JEREMY Corbyn’s massive renationalisation plans would risk “years of disruption”, according to the Institute for Fiscal Studies.

The think tank warned the impact of the massive buyouts would not only leave Britain with debts of £150 billion but Labour has not provided a plan to manage the new networks.

Under current proposed Labour plans the IFS say that five per cent of private companies will be nationalised, swelling the public sector workforce by 310,000.

IFS Research Economist Lucy Kraftman said: “The industries that Labour plan to nationalise are vital to the UK economy.

“The key question is whether they would be better managed in the public sector, and what nationalisation can achieve that changing the current regulatory frameworks cannot.

“In the short run Labour’s plan would lead to significant disruption.”

Labour’s 2019 general election manifesto pledged to “bring rail, mail, water and energy” alongside “the broadband-relevant parts of BT” under government ownership.

But the IFS warned purchasing them will be tricky as valuing the companies – some of which are in foreign ownership – risks damaging the UK’s reputation.