Britain’s Brexit bonus as Bank of England admits there was NO slump after Leave vote

The markets have also stabilised after the vote

STUNNED Bank of England chiefs said Britain had weathered the storm of the Brexit vote with little sign of a slowdown in the economy.

In a staggering about-turn, the Bank said that for many British companies it was business as usual.

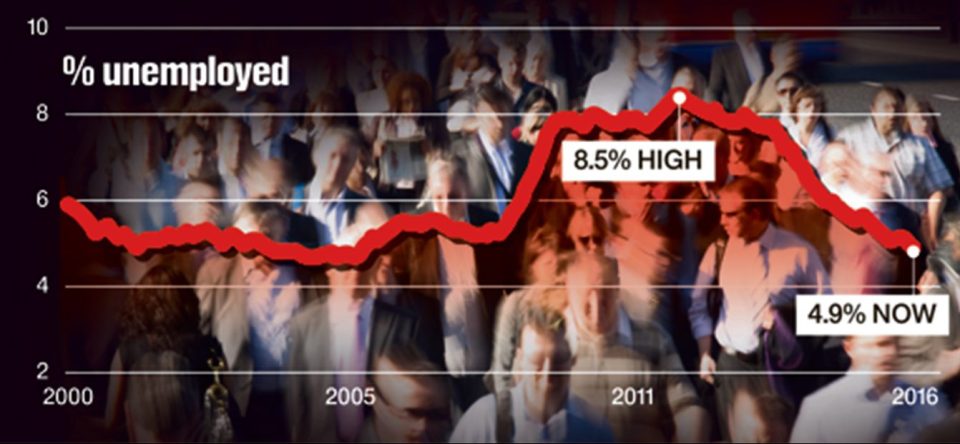

It came as official job figures revealed employment surged to a record high in May and the jobless rate had fallen below five per cent for the first time since 2005.

The double dose of good news saw the FTSE 100 stock index close above 6700 for the first time and the Pound rise against the US dollar.

It marked the second day in a row where officials caught up in Project Fear before the Referendum were forced to reveal the carnage they predicted had yet to appear.

In a report by the Bank, its agents said some firms were even considering bringing production back from overseas due to the low Pound.

While there was a surge in uncertainty there had been “no clear evidence of a sharp general slowing in activity”.

The Bank said some big multinationals warned they may invest more overseas, and fresh food prices could rise.

But the report marks a stark contrast to the apocalyptic warnings from governor Mark Carney in May.

The report came 24 hours after the IMF said post-Brexit Britain was now likely to avoid a recession.

related stories

The IMF slashed growth predictions for the UK economy for 2017 but admitted growth would still top Germany and France.

Separate job figures showed that employment leapt by 176,000 to 31.7million in the three months to the beginning of June — before the referendum. The employment rate hit a record high of 74.4 per cent.

And the figures revealed unemployment dropped 54,000 to 1.65million. The proportion of working age people out of work is 4.9 per cent, the lowest since September 2005.

New Work and Pensions Secretary Damian Green said: “Our job now is to build on this success story.”

Just the job

BRITS should “keep calm and carry on” as the referendum panic is over, a senior Bank official declared last night.

Kristin Forbes, one of nine interest rate setters, said money markets had stabilised after the Brexit vote.

She insisted Britain was not anywhere near as vulnerable as at the height of the banking crisis in 2008 when Lehman Brothers collapsed.

But she admitted the uncertainty caused by Brexit would cost Britain its place as the fastest-growing advanced economy.

She also said now was not the time to cut interest rates.