Brit Wolf of Wall Street gang using ‘scam Bible’ to trick Brit OAPs out of millions before splashing it on ‘cocaine and booze-fuelled parties’

The Sun reveals a mob of 20 Brits based in in Marrakech, Morocco, have running an art investment fraud

A BRITISH “Wolf of Wall Street” gang are conning UK pensioners out of millions of pounds by swiping their details from companies such as Sainsbury’s before pressuring them to invest in bogus artwork.

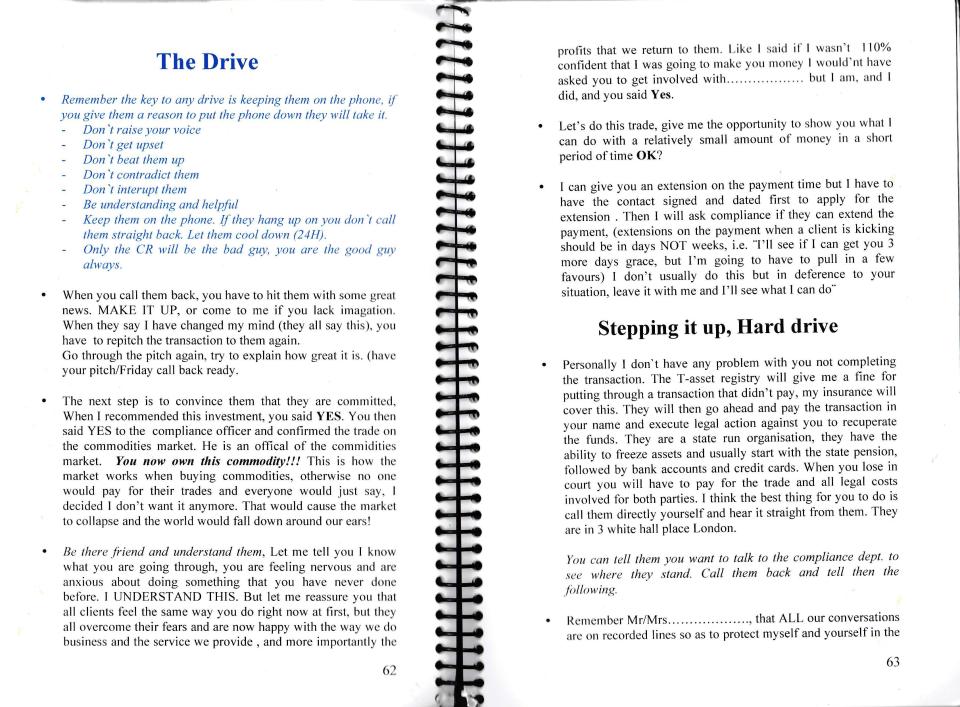

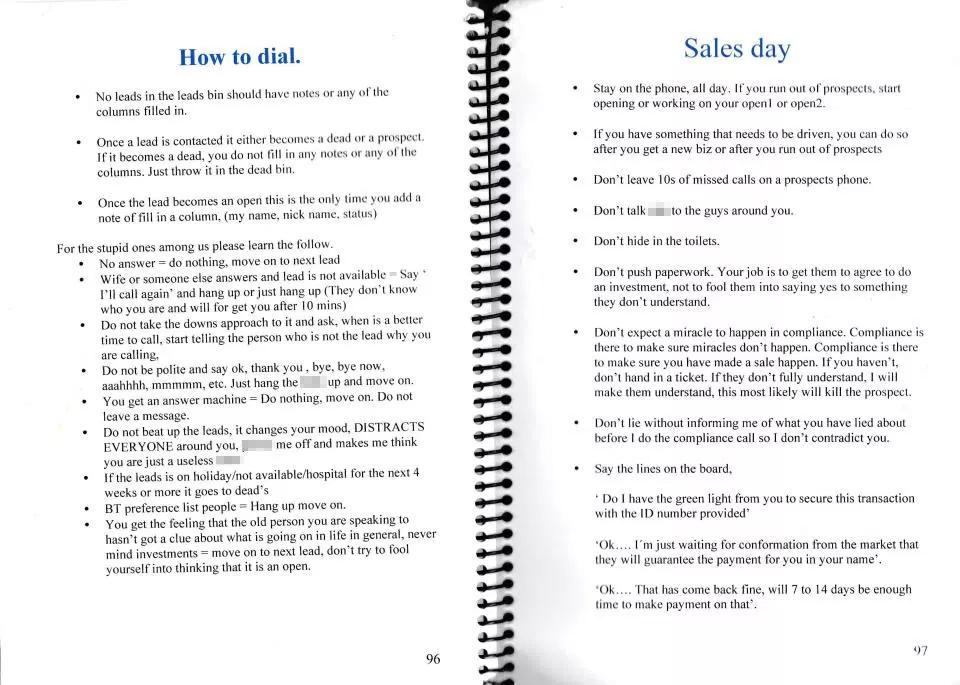

The shameless con artists use a cynical "scam Bible" filled with tips like "be their friend" and "make up" stories to force unsuspecting pensioners to hand over cash.

The vile con artists then splash the ill-gotten gains on cocaine and champagne parties from their base in Morocco.

The Sun Online can reveal victims, most of whom are old and vulnerable, are targeted through legally-available shareholder data from major UK companies.

Con artists ring up victims to discuss their current UK company investment, before offering the chance to invest in the art – which the fraudsters claim will only grow in value.

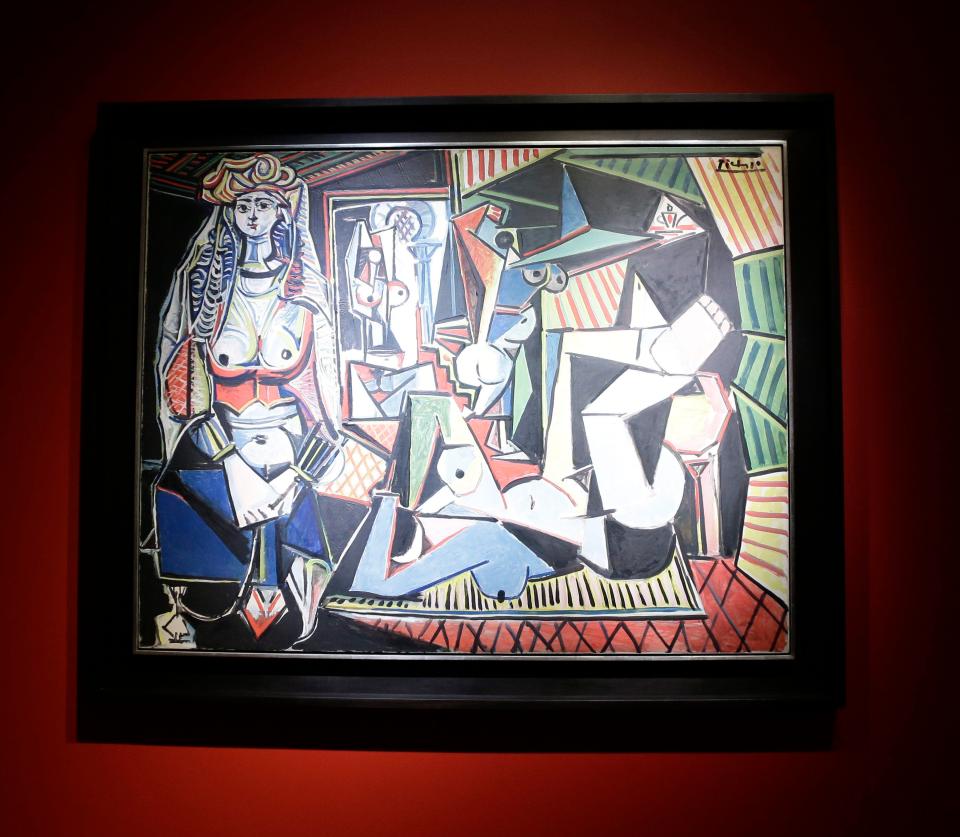

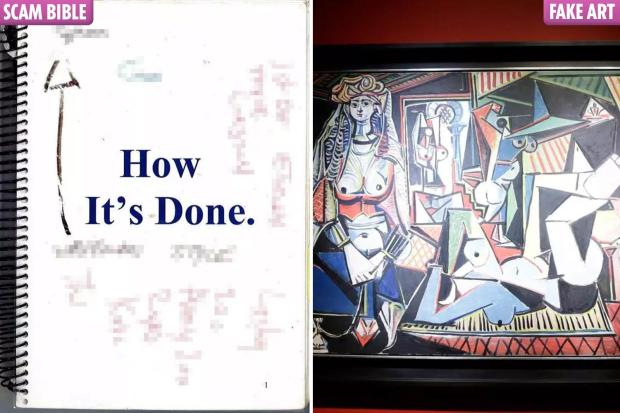

In reality once the victim has agreed to the deal they are relentlessly bullied into handing over several thousand pounds for which they get a Dali or Picasso print worth little more than £60.

The scammers, who are the subject of an international police investigation, often return to vulnerable victims in a bid to scam them for even more cash by claiming they are offering huge investments in real artwork.

One victim, 82, was targeted for £5,000 and her horrified daughter told The Sun: “They initially called her discussing a shareholding she had in Sainsbury’s and saying it was under-performing.

I was furious and emailed them threatening to report them.

Victim's daughter

“Then they start talking about investing in art and drop in a few names like Dali and Picasso and are asking her for £5,000. She agreed to receive the pack they sent from Spain by courier just to get them off the phone.

“A week later my mum rings me in hysterics, she’s been through a lot and I’ve never heard her like that.

“She said they were threatening her with legal action and were going to sue and that she’s never been in trouble with the law before, what is she going to do?

“They said they had a ‘large legal department’ and that ‘we will come after you’ to my mum. I was furious and emailed them threatening to report them.”

Whistleblowers told The Sun how the mob of around 20 Brits – working out of a swanky city centre office block in Marrakech, Morocco – splurge the stolen cash on parties in the oasis city’s nightclubs and bars.

They described how the gang – led by a cocaine-addled 42-year-old originally from Cambridge – start partying each week on Friday afternoon with a three-hour lunch and “loads of wine and champagne”.

A group of the top performing staff then move on to the city’s 24-hour Pacha nightclub each week – celebrating the week’s scam deals.

How to spot investment scams

FRAUDSTERS are very good at their job, using persuasive language and underhand tactics to pressurise people into parting with their cash.

Typically they contact would-be victims out of the blue, by phone or email. They present their proposal as the chance of a lifetime.

Scammers tend to insist you commit to the investment and transfer money to them immediately. They do not want you to have some thinking time or to discuss the proposal with someone else who could think it’s a con.

Fraudsters often state they need to know immediately as the opportunity is so good that it is being snapped up and you will miss out if you don’t get on board there and then.

If you're unsure if an investment is legitimate, check the for companies that are able to operate in the UK.

If you suspect that you have given money to a scammer, contact your bank immediately. Ask them to put a freeze on any money that has not left your account.

Report the scammer to the FCA using its .

Finally, contact which will be able to offer advice on what next steps you can take.

There the gang spends thousands of pounds in cash – paid for in euros – on champagne, cocktails and food both on Friday and Saturday night.

They also described how workers can steal anything from £3,000 up to one reported case of a £420,000 scam from a Brit pensioner.

The gang has been likened to the notorious stockbrokers in the blockbuster Wolf of Wall Street film starring Leonardo DiCaprio as the corrupt New York trader Jordan Belfort.

Staff flip between scam callers claiming to be officials from a “Treasury Assets” department who manage investments in original artwork or lawyers who harangue victims into paying for the prints.

The Sun can also reveal the fraudsters use a well-worn “scam bible” to bully victims into parting with their cash and which is menacingly titled “How It’s Done”.

In the 97-page booklet handed to The Sun, it tells fraudsters to “make up” stories or to “come to me (the boss) and I’ll make one up for you”, when talking to targets.

Staff are told to threaten legal action after taking victim’s details if they refuse to cough up cash having “agreed” to be part of the fake investment.

The book describes how scammers can “beat the s***” out of victims and explains how to lie about why the Financial Conduct Authority may have sent out an online scam warning on their company.

It also describes how scammers should lie as to why paper documents about investments are not posted out and to drop phone lines if a different person to the listed shareholder target picks up the phone.

Fraud cops estimate investment crooks are stealing almost £200million-a-year from Brits with the real figure thought to be much higher as victims are often too ashamed to report the crimes.

The gang in Morocco is connected to a global network of investment scammers stretching from Singapore, Cambodia through to Eastern Europe and Spain.

They are said to have stolen millions of pounds from victims over a decade of operating in Marrakech, where they have been several years, and before that Madrid.

The gang continue to operate by regularly changing their company name online and setting up new sites to work around authorities’ alerts that they are a scam.

I lost £40,000 of savings to telephone investment crooks

Jeffrey Taylor, 43, has spent the past 13 years trying to get his life back on track after being swindled out of £40,000 of savings by crooks who rang him promising an easy win on his investments.

He even took out loans and maxed out several credit cards to finance the investments after being pressured by fraudsters.

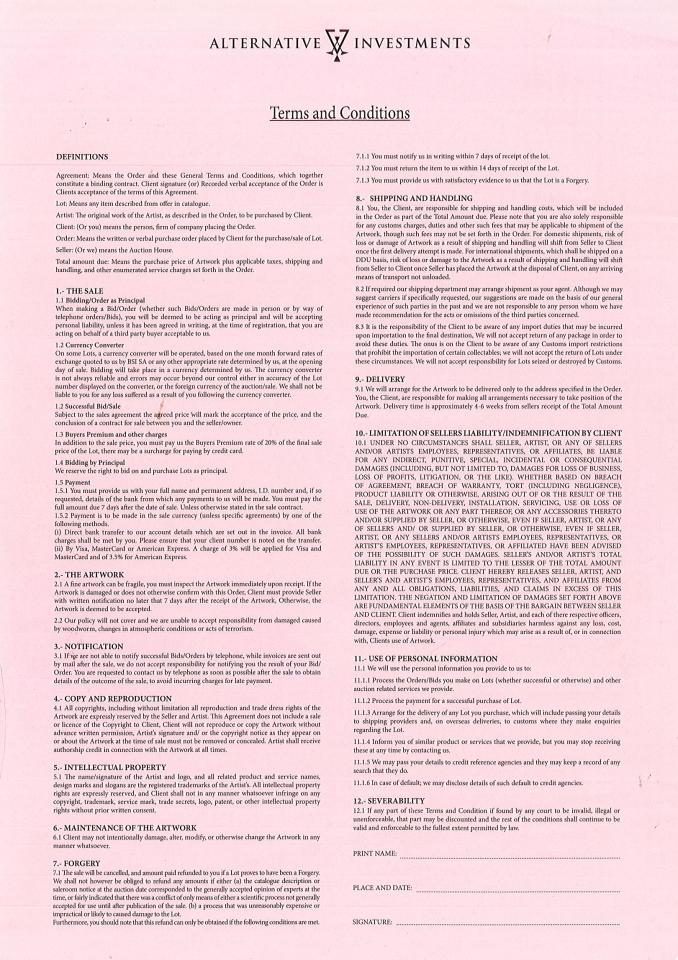

The Sun has located at least two victims while the firm traded under the name Asset Consulting Services.

The accompanying website gives an office address in Canary Wharf, London, which whistleblowers claim can be used to collect cheques and postal order payments though office managers claimed to have no records of the firm.

A financial switchboard service registered through the company's Hong Kong number refused to transfer our calls without the full name of a member of staff, saying "it's a private company".

Other details provided such as the company’s website details did not match any records while the Financial Conduct Authority has issued an alert about the firm.

And we have learnt three UK police forces have launched investigations into the group following Action Fraud reports with one 30-year-old suspect from Crawley, West Sussex, arrested for money laundering in connection with the scammers.

The National Crime Agency has also referred fraud reports via Europol to Spanish authorities because of the group’s links to Spain.

After enquiring about fraud reports linked to the gang a spokesman for City of London police, the UK lead on fraud investigations, said: “Action Fraud received reports from victims and they were assessed by the National Fraud Intelligence Bureau (NFIB).

More Sun investigations

“The NFIB then disseminated them to the Metropolitan Police Service, North Wales Police and Sussex Police to consider for investigation.”

The Met Police charged one UK-based suspect who was cleared in court while cops have arrested a 30-year-old man on suspicion of money laundering in connection with the gang.

A Sainsbury’s spokeswoman, regarding allegations the gang targeted their shareholders, said: “We have processes in place to protect our shareholder information and always advise shareholders to be vigilant against unsolicited investment advice.”